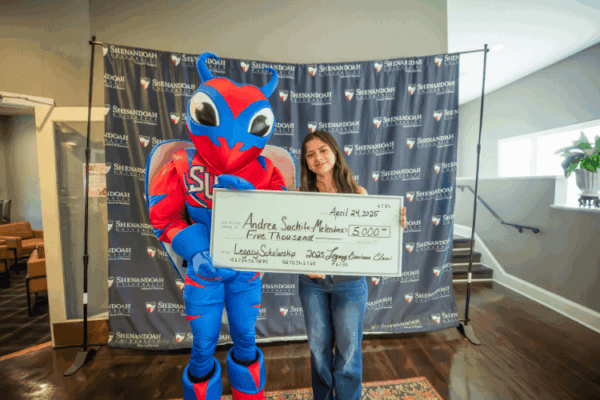

Shenandoah University School of Business Hosts Inaugural Legacy Golf Tournament, May 7

Annual Event To Benefit Scholarships For First-Generation Regional Applicants

The Shenandoah University School of Business will host its first-ever Legacy Golf Tournament at Winchester Country Club on Friday, May 7. Sponsored by the Class of 21, check-in begins at 10:30 a.m. and tee-off is at noon. The tournament’s goal is to raise money for scholarships to support first-generation, high-achieving local applicants who want to major in business.

We’re really excited about the support we’ve received so far from the community, as well as the energy of the students organizing the tournament. For our region to continue to grow and prosper, we need a vibrant and vital business community. And it starts with keeping our best and brightest close to home.”

Astrid Sheil, Ph.D. | Dean | Shenandoah University School of Business

Dr. Sheil believes supporting the Legacy Golf Tournament is an investment in the community that will pay dividends for years to come.

Individual registration is $150. Team registration options range from $600 for four players to $1,000 for four players, depending on package add-ons. A variety of sponsorship opportunities are also available. Players will compete for the longest drive and closest to the pin, as well as a putting contest. A silent auction, reception and award ceremony will close out the day with prizes.

Tournament registrations are filling quickly. Whether you are an avid golfer or just hoping for a great day on the course, register a team or become a sponsor. Learn more at www.su.edu/golf.

Questions? Contact Stephanie Swaim at (540) 665-4572 or email business@su.edu.

Shenandoah University is a 501(c) (3) organization (Tax I.D. #54-0525605). Pursuant to the IRS code, we are required to inform you that the amount of the contribution that is deductible for federal income tax purposes is limited to the amount of money, and the value of property other than money, contributed by you over the value of goods or services provided by the organization.